Edit Content

Get an Expert for Simplifying Business Registration

Experienced. Well disposed. Proficient.

Starting a new business? Filing Tax? Applying for Trademark? or for any other legal/financial aid, let us guide you.

Edit Content

INDIA’S LARGEST PLATFORM

Last year we have registered 3000+ companies in India

We are a consulting and financial management company providing bespoke services to Individuals, MSMEs, Startups and Large Enterprises

Edit Content

India's Largest Platform

Tax-related services

Expert Solution

Tailor-made tax filing

we are a consulting and financial management company providing bespoke services to individuals, MSMEs, Startups and Large enterprises

Best Taxation Service

Delivering Excellence in Taxation Services. We provide top-notch taxation services for businesses and individuals

Business Strategy & Growth

It helps organizations aiming to expand their operations, increase revenue, and enhance market reach.

Highly Dedicated Worker

It’s crucial to enlist the expertise of dedicated professional collaboration with experts ensures an effective growth strategy.

We Are The Best Solution For Simplifying Business Registration

We provide one stop solution to individuals, entrepreneurs, startups, micro, small, medium and large enterprises for starting, managing and growing their businesses. We are providing tailor-made solutions in Taxation, Filing, GST,Simplifying business Registration, Compliances, IPR, Licensing & Branding

Professional Team

High Savings Potential

Learn From Customer Feedback

24/7 Customer Support

Years Experienced

0

+

Our Services

We provide financial consultations & one stop solutions

to businesses and individuals in India & Abroad seeking financial, tax based or business related help to grow and expand

Simplifying Business Registration

Simplifying Business Registration, Change in Business Constitution, NGO Registration, International Business Registration

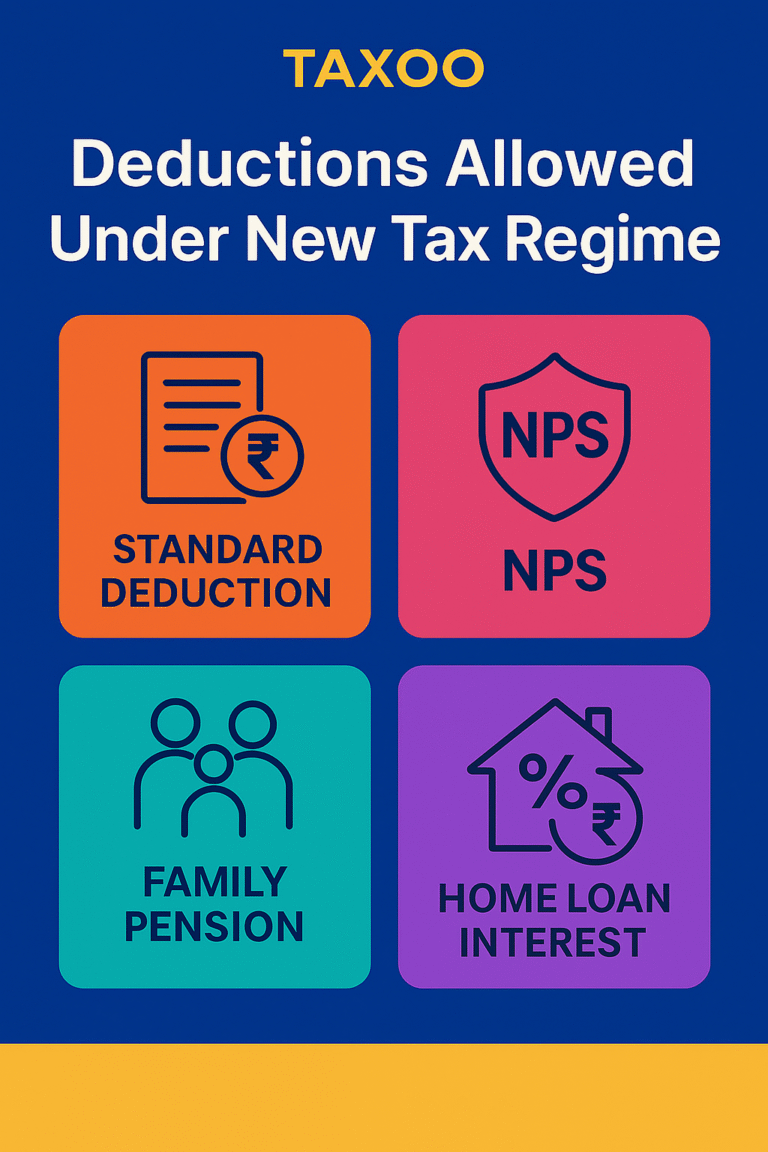

Taxation

Income Tax Filing, TDS Return Filing, GST Registration, GST Filing, TDS Return Filing

IPR Registration

Trademark, Copyright, Geographical Indication, Design Registration, Patent, Litigation, Objection Reply

Needs Professional Tax Service? Contact Us

Starting a new business? Filing Tax? Applying for Trademark? or for any other legal/financial aid, let us guide you.

Case Studies

Let’s See Our Latest Project

We assist Startups, SMEs, and large-scale Enterprises in accelerating growth and expansion.

Permissive Tax Planning

It’s all about strategically maximizing the benefits that the tax code allows while staying within legal boundaries.

Purposive Tax Planning

It’s all about strategically applying the right tax provisions to achieve some specific objectives. Like: Asset Replacement, Smart Investment Selection etc.

Short-range Tax Planning

planning that is thought of and executed at the end of the income year to reduce taxable income in a legal way. It’s all about optimizing your tax situation within the current fiscal year

Our Pricing

Affordable Pricing Plans Business Registration

We assist Startups, SMEs, and large-scale Enterprises in accelerating growth and expansion. We provide financial & business consultation at affordable price

-

Register Your Business

-

Get Licenses & Registration

-

Easy Tax Registration & Filling

-

Mandatory Compliances

Edit Content

Private Limited

Company

₹

12499

-

The default option for start-ups and growing businesses as only private limited companies can raise venture capital. This type of company offers limited liability for its shareholders with certain restrictions placed on the ownership. Private limited company registration, directors may be different from shareholders.

Public Limited Company

₹

21499

-

A Public Limited Company is a company that has limited liability and offers shares to the general public. It’s stock can be acquired by anyone, either privately through (IPO) initial public offering or via trades on the stock market. A Public Limited Company is strictly regulated and is required to publish its true financial health to its shareholders. Also called publicly held company.

Limited Liability

Partnership

₹

10499

-

LLP was introduced to provide a form of business that is easy to maintain and to help owners by providing them with limited liability. Limited Liability Partnership Registration combines the benefits of a partnership with that of a limited liability company.

One Person

Company

₹

10499

-

The best structure for solo entrepreneurs looking beyond the opportunities a sole proprietorship affords. Here, a single promoter gains full authority over the company, restricting his/her liability towards their contributions to the enterprise. The said person will be the sole shareholder and director.

Edit Content

Shops & Establishment

Registration

₹

1999

-

The default option for start-ups and growing businesses as only private limited companies can raise venture capital. This type of company offers limited liability for its shareholders with certain restrictions placed on the ownership. Private limited company registration, directors may be different from shareholders.

FSSAI

registration

₹

1999

-

LLP was introduced to provide a form of business that is easy to maintain and to help owners by providing them with limited liability. Limited Liability Partnership Registration combines the benefits of a partnership with that of a limited liability company.

ISO

Certification

₹

2499

-

The best structure for solo entrepreneurs looking beyond the opportunities a sole proprietorship affords. Here, a single promoter gains full authority over the company, restricting his/her liability towards their contributions to the enterprise. The said person will be the sole shareholder and director.

Import - Export

Code

₹

1499

-

A business structure in which two or more individuals manage a business per the terms in Partnership Deed. It’s best suitable for home businesses that are unlikely to take any debt due to low cost, ease of setting up and minimal compliance requirements.

Edit Content

Goods & Service tax

Registration

₹

2499

-

GST registration is the process of obtaining a unique identification number for a business liable to pay Goods and Services Tax (GST). Under GST, firms with an annual turnover of more than ₹40 lakh (or ₹20 lakh for some special category states) must register as normal taxable entities.

Goods & Service Tax Filing

As per Scope

-

Price as per the scope of work decided.

All GST-registered businesses must file monthly or quarterly GST returns and an annual GST return based on their business type. These filings are done online on the GST portal. A GST return contains details of income/sales and expenses/purchases, which tax authorities use to calculate net tax liability.

Income Tax

Return

As per Scope

-

Price as per the scope of work decided

An income tax return refers to the various tax forms that individuals or businesses fill out to report their income and expenses to the tax authorities, such as the IRS in the United States or the Income Tax Department in India.

TDS

Return

As per Scope

-

Price as per the scope of work decided.

A TDS return is a quarterly statement summarizing all TDS-related transactions made during a specific quarter. It includes details of the TDS collected and deposited to the Income Tax Authority by the deductor1. If you’re a deductor, you’ll need to file TDS returns regularly to comply with tax regulations.

Edit Content

Maintain Your

Accounts

Enquire Now

-

Prices as Scope of Work Mutually Decided Maintaining books of accounts is crucial for businesses to keep accurate records of their financial transactions. Here are the primary aspects related to maintaining books of accounts in a company:

Annual Compliance

Pvt Ltd Company

₹

21499

-

Annual compliance for companies in India refers to the set of legal obligations that companies must fulfill each year. These requirements ensure proper governance, transparency, and adherence to regulations. Here are some key aspects of annual compliance for private limited companies: Disclosure of Directors’ Interest (Form MBP-1) Disclosure of Non-Disqualification (Form DIR-8) Delay in Payment to MSME Vendors (Form MSME-1) KYC of Directors (Form DIR-3) Required annually by September 30 for all directors. Return of Deposit (Form DPT-3) Circulation of Financial Statements

Popular

Annual Audit Related

Services

As per Scope

-

Price as per Scope of Work Decided.

Audit-related services refer to non-audit services closely related to the work performed in an audit engagement. These services are typically carried out by members of the audit team who must comply with independence requirements. Here are a few examples of audit-related services:

1. Financial Statement Audit

2. Setting Up Financial Systems and Controls.

3. Other Services Not Requiring an Opinion on Financial Statements.

Secretarial Audit package for companies

As per Scope

-

Price as per Scope of work Decided.

Secretarial audits are mandatory for specific companies under the Companies Act, 2013. These include:

1. Public companies with a paid-up share capital of ₹50 million or more.

2. Companies with an annual turnover of ₹250 million or more.

3. Companies listed on stock exchanges.

Our Team

Behind Our Company

Discover our team of expert consultants specializing in taxation, GST, Simplifying Business registration, compliance, IPR, licensing, and branding. We deliver tailored financial solutions with dedication and professionalism

Testimonials

What Our Clients Says

We were impressed by the seamless process of incorporation services provided for our company's incorporation. From legal paperwork to tax registration, they handled it all efficiently. Their team’s expertise saved us time and ensured compliance. We’re grateful for their professional service!

Anju is a clear and concise communicator, she is effective in her work. We are so thankful that she has handled the taxes for my family for years, She kept things straight for us across state moves, through multiple jobs, juggling random expenses, credits, and military service. Anju also handles my parents' taxes well with multiple travel contracts across multiple states and endless other complexities, and she does it with grace.

Mr. Prateek is professional and approachable. We have used his services for years...not planning to go anywhere else or try to do our taxes ourselves. he's a definite keeper!

Amit is the best! A true pro with a great work ethic and understanding. I am so grateful to have such a seasoned professional on my side. I have been grateful to his for many years.

Let a Dedicated Expert for Simplifying Business Registration for You. Get A Consultation

Starting a new business? Filing Tax? Applying for Trademark? or for any other legal/financial aid, let us guide you.

Our Blog

Common Mistakes to Avoid While Registering Your Startup

Understanding Due Diligence: A Key to Informed Decision-Making In the fast-paced world of business, making informed decisions is essential to ensure sustainable growth and success. This is where due diligence comes into play—a process that serves as the backbone of confident decision-making. Whether you’re considering a merger, acquisition, or investment, conducting thorough due diligence is […]

ROC Due Date Compliance Calendar FY 2025-26 Ensuring compliance with the ROC (Registrar of Companies) filing due dates is critical for businesses to avoid penalties and maintain good standing. For the financial year 2025-26, here’s an exhaustive guide to help you stay ahead of the deadlines and fulfill your compliance obligations efficiently. Why ROC Compliance […]

Understanding the Importance of Statutory Audit for Your Business As a business owner, maintaining transparency and accountability is paramount. One way to achieve this is through statutory audits. These audits are not just a regulatory requirement but also a means to ensure the accuracy and fairness of your company’s financial statements. In this blog, we […]

Table of Contents How to Register a Private Limited Company in India Starting a business in India is an exciting journey, but the process of registering a Private Limited Company (Pvt. Ltd.) can be daunting. This comprehensive guide will help you navigate the registration process with ease. Why Choose a Private Limited Company? A Private […]

Key highlights of Section 14A Introduction As per Section 14A of Income Tax Act, 1961, some of the Incomes is not Taxable (i.e. Exempt from Income tax), Like agricultural Income, Dividend Received from a company, Income received by charitable institution, and tax-free interest received. In fact, Expenditure which relates to that Income which is not […]

Newsletter

Signup our newsletter to get update information, insight or news